Maximizing Value: The Critical Role of Knowledge Capital in M&A Success

The successful integration of knowledge capital—encompassing expertise, tacit knowledge, inte…….

The successful integration of knowledge capital—encompassing expertise, tacit knowledge, intellectual property, and organizational know-how—is essential for mergers and acquisitions (M&A) to yield positive post-merger performance. Unlike tangible assets, knowledge capital is deeply ingrained within a company's workforce and operational processes. Acquiring entities must strategically integrate this intangible asset to harness its potential for innovation and efficiency. This involves not only absorbing the explicit information from the acquired firm but also safeguarding its implicit knowledge, including industry insights, customer relationships, and proprietary technologies. A meticulous approach to managing knowledge capital is necessary to align M&A activities with long-term objectives, ensuring value creation for stakeholders through systematic knowledge transfer, cultural alignment, and protection of intellectual assets. Intellectual property (IP) plays a crucial role in this process, acting as a tangible element of knowledge capital that confers competitive advantages. Companies must conduct thorough due diligence to assess IP value, leveraging various methodologies like cost, market, and income approaches. The strategic alignment of an entity's IP with the acquirer's existing knowledge base can significantly enhance innovation potential and competitive positioning. In M&A, the effective integration of knowledge capital is vital for achieving post-merger success by driving growth, operational efficiencies, and fostering innovation. This process must be executed with careful planning and adherence to legal and ethical standards to ensure the protection and transfer of knowledge are conducted responsibly and in compliance with data protection laws and privacy regulations. Examples like IBM's acquisition of Red Hat and Apple's acquisition of Shazam demonstrate the strategic importance of integrating target companies' unique knowledge assets to achieve synergistic outcomes and enhance market positions post-M&A.

mergers and acquisitions often hinge on the strategic leverage of knowledge capital. This article delves into the intricacies of how this intangible asset plays a pivotal role in shaping deal outcomes. We explore its definition, importance, and assessment during M&A transactions. Key sections cover intellectual property’s value, identifying knowledge capital within target companies, and integration strategies post-merger. Additionally, we examine the legal and ethical dimensions of transferring this asset across transactions. Case studies highlight successful mergers and acquisitions that have effectively utilized knowledge capital as a cornerstone for growth and market dominance.

- Understanding Knowledge Capital within Mergers and Acquisitions

- The Role of Intellectual Property in Valuing Knowledge Capital

- Identifying and Assessing Knowledge Capital across Target Companies

- Synergies and Integration Strategies for Enhancing Post-Merger Knowledge Capital

- Legal and Ethical Considerations in Transferring Knowledge Capital Across Transactions

- Case Studies: Successful Mergers and Acquisitions Leveraging Knowledge Capital

Understanding Knowledge Capital within Mergers and Acquisitions

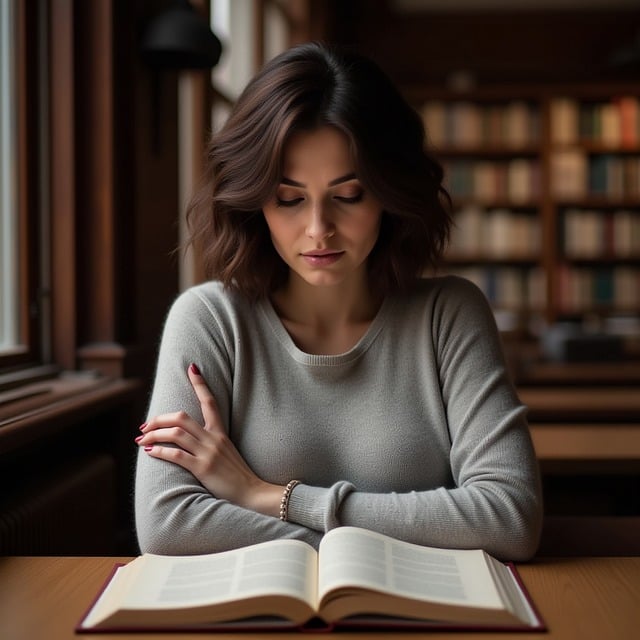

In the realm of mergers and acquisitions (M&A), the concept of knowledge capital emerges as a pivotal element that can dictate the success or failure of post-merger integration. Knowledge capital encompasses the collective expertise, tacit knowledge, intellectual property, and organizational know-how that an entity possesses. Unlike tangible assets, this intangible asset is deeply embedded within the workforce and operational processes of a company. For acquiring companies, integrating this knowledge capital is crucial for leveraging the combined entity’s potential. It involves not only assimilating the acquired firm’s explicit information but also understanding and preserving its implicit knowledge, which includes industry insights, customer relationships, and proprietary technologies. Successful integration of knowledge capital can lead to synergies that enhance innovation, improve operational efficiency, and ultimately contribute to competitive advantage. Companies must strategically manage this intangible asset to ensure that the M&A activity aligns with long-term objectives and creates value for stakeholders. In this context, a systematic approach to knowledge transfer and cultural alignment is essential to harness the full potential of the combined entity’s knowledge capital. This approach necessitates careful planning, clear communication channels, and a commitment to preserving the integrity of both organizations’ intellectual assets during the M&A process. By doing so, companies can avoid common pitfalls that often accompany such transformative events, ensuring that the integration is not only efficient but also effective in maximizing the value derived from the knowledge capital at their disposal.

The Role of Intellectual Property in Valuing Knowledge Capital

In the realm of mergers and acquisitions, intellectual property (IP) stands as a pivotal component in valuing an organization’s knowledge capital. IP encompasses patents, trademarks, copyrights, trade secrets, and other proprietary technologies that embody the culmination of research and development efforts. It represents the intangible assets that can provide a lasting competitive advantage. Companies often acquire others to gain access to this intellectual property, which can be leveraged for innovation, market expansion, or cost reduction. The valuation of knowledge capital is complex, as it involves assessing the economic value and potential impact of these IP assets on future profitability. Analysts employ various methodologies, including cost, market, and income approaches, to determine the worth of intellectual property within a company. This process requires a nuanced understanding of the IP landscape, including the strength of patents, the novelty of inventions, and the enforcement history, as these factors significantly influence the perceived value and subsequent integration into the acquiring entity’s portfolio.

Furthermore, the strategic alignment of intellectual property with the acquirer’s existing knowledge base is critical. A synergistic merger or acquisition that effectively combines IP assets can result in a significantly enhanced knowledge capital. This synthesis not only amplifies innovation capabilities but also positions the combined entity to outpace competitors by leveraging a broader spectrum of intellectual property. In such transactions, the due diligence process must meticulously evaluate the quality and breadth of the target’s IP portfolio to ensure that the acquisition will indeed enrich the knowledge capital of the resultant enterprise. The role of intellectual property in this context is undeniably central; it underpins the value proposition of mergers and acquisitions, offering a clear pathway for long-term growth and profitability.

Identifying and Assessing Knowledge Capital across Target Companies

Synergies and Integration Strategies for Enhancing Post-Merger Knowledge Capital

In the realm of mergers and acquisitions, the integration of knowledge capital is a critical factor for post-merger success. Organizations often pursue mergers and acquisitions with the objective of combining their resources to enhance market presence, streamline operations, or innovate more effectively. A key aspect of this integration involves the alignment of intellectual assets and expertise. Companies must strategize on how to synergize the knowledge bases from both entities to create a robust knowledge capital that surpasses the individual contributions. This can be achieved through meticulous planning and the implementation of integration strategies that focus on identifying, preserving, and leveraging the unique competencies each organization brings to the table. By doing so, businesses can foster an environment where cross-pollination of ideas leads to novel insights and competitive advantages. The process demands a clear understanding of the knowledge capital within each entity and how it complements or enhances the other’s capabilities. It is through this collaborative approach that companies can optimize their combined knowledge capital, ensuring a cohesive post-merger entity that is greater than the sum of its parts.

Post-merger integration also necessitates a focus on retaining and building upon the specialized knowledge capital that each organization has developed. This involves creating systems that facilitate the sharing and transfer of knowledge, encouraging collaboration among staff, and establishing clear communication channels. The aim is to ensure that the intellectual property and tacit knowledge, which are often the true sources of value in a merger, are not lost but rather harnessed to drive innovation and growth. Organizations that successfully integrate their knowledge capital post-merger can expect to see improved performance, increased efficiency, and enhanced creativity, all of which contribute to a stronger market position and a more resilient enterprise. The integration of knowledge capital is thus a strategic imperative for companies undergoing mergers and acquisitions, with the potential to transform the resulting entity into a formidable force in its industry.

Legal and Ethical Considerations in Transferring Knowledge Capital Across Transactions

In the realm of mergers and acquisitions, the transfer of knowledge capital emerges as a pivotal aspect that necessitates careful legal and ethical scrutiny. The integrity of intellectual assets and proprietary information must be safeguarded throughout the transaction process to ensure compliance with data protection laws and privacy regulations. Legal frameworks dictate the manner in which knowledge capital can be transferred, with specific contracts and confidentiality agreements outlining the rights and obligations of all parties involved. Ethical considerations further underscore the importance of transparent dealings, where the transfer of knowledge does not infringe upon the rights of employees or third parties, nor does it lead to anti-competitive practices. The due diligence phase is critical for identifying and addressing any potential legal or ethical issues related to the transfer of knowledge capital, ensuring that all intellectual property is accounted for and that the terms of the transaction are aligned with industry standards and ethical norms. Navigating these considerations is essential for the successful integration of knowledge capital, fostering a seamless transition post-merger or acquisition and laying the foundation for sustained innovation and competitive advantage.

Case Studies: Successful Mergers and Acquisitions Leveraging Knowledge Capital

Companies such as IBM and Apple have historically demonstrated the power of leveraging knowledge capital in their mergers and acquisitions (M&A) strategies, which has often led to successful outcomes. For instance, IBM’s acquisition of Red Hat in 2019 is a prime example of a company that effectively utilized knowledge capital to enhance its capabilities and innovate at an accelerated pace. The integration of Red Hat’s open-source expertise with IBM’s existing portfolio created a synergy that expanded their hybrid cloud offerings, positioning them as leaders in the rapidly evolving tech landscape. Similarly, Apple’s acquisition of Shazam in 2017 allowed it to incorporate advanced audio recognition technology into its ecosystem, thereby bolstering its product lineup and user experience with minimal disruption to both the acquired entity and its user base. These cases highlight the strategic advantage that arises when companies recognize and capitalize on the unique knowledge assets of their targets, leading to seamless integration and enhanced market position post-M&A.